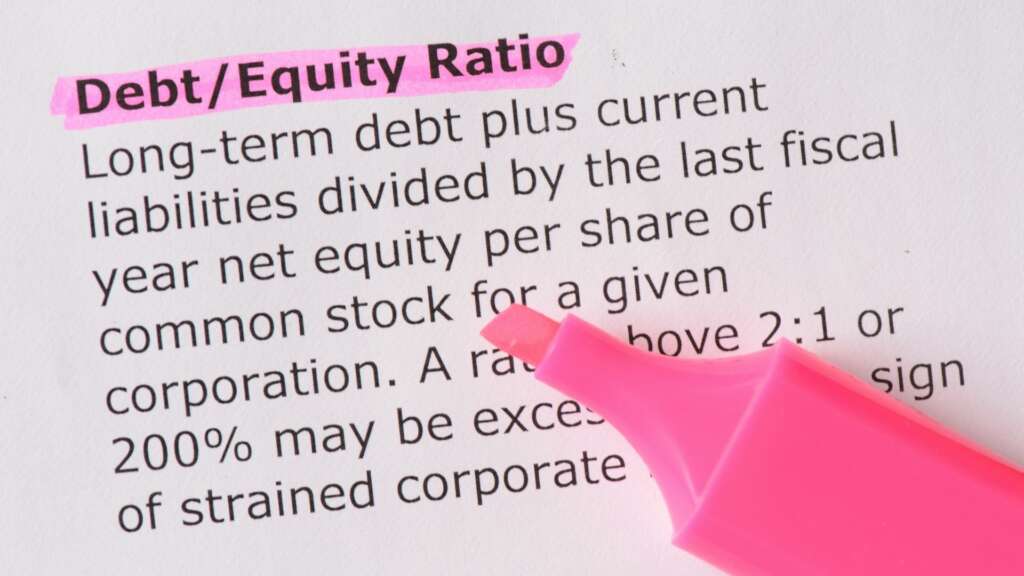

The debt-to Equity ratio refers to the ratio of debt to total equity of a business. It shows how much debt is owed in relation to the value of the business. This type of ratio can provide an excellent indicator of a business’ creditworthiness.

The debt to equity ratio shows the percentage of debt versus total equity of a business. It closely resembles leverage, debt-pricing or gearing. A company’s debt to equity ratio (D/E ratio) is based on its ownership structure. The more common and less common business structures are: partnership, joint-venture, ownership by an investor, lease, ownership of fixed assets, and ownership of an asset through an entity. Each of these types has its own debt and equity components and they have different implications for a company’s ability to generate funds.

For example, a joint-venture relationship is generally beneficial to a business because there is no requirement that the business use its own resources to fund the venture. On the other hand, a sole-sales contract is considered unfavorable, because it limits a business’ ability to raise funds from existing customers.

Debt-pricing relates to the ability to purchase a security at a given interest rate. This means that the interest rate of a security directly relates to the amount that can be borrowed by the borrower. The lower the interest rate, the larger the amount that a borrower can borrow to buy a security. This type of ratio can be an indicator of a business’ ability to generate cash flow.

Debt-leverage refers to the ability to purchase a security with a specified percentage of capital raised by the loaned amount. An example of this type of ratio relates to a loan taken to finance equipment. If the loaned amount is equal to or greater than the total capital raised, the business will have an advantage in determining the interest rate that is charged on the equipment.

Debt-pricing and debt-leverage are often confused with each other. In addition to being concerned with a business’s ability to generate capital, the ratios show the risk of the borrower in the transaction. The higher the ratio, the greater the risk for the borrower and vice versa. Because of this risk factor, it is important to evaluate a business’s financial statements and perform a balance sheet to determine the risk level associated with debt.

The debt to equity ratio of a business is useful for two reasons. First, it provides a comparative look at the debt burden of the business against the equity of the business and a second reason is that the ratio gives investors an idea of a business’s ability to generate cash flow. When evaluating a business’s debt-to-equities ratio, it is important to consider the creditworthiness of the business because there are many factors that impact the debt to equity ratio.

The debt to equity ratio can be used to evaluate a business’ viability. It can help an organization determine whether a business can continue to operate based on the current market and economic environment. The ratio of debt versus equity provides an indicator of the amount of equity needed to finance the business. Additionally, it helps a business to determine whether the company will meet its debt and credit requirements.

The debt to equity ratio is a ratio of the equity of the company to the total debt outstanding. The debt-to-equity ratio can be used to evaluate a business’s profitability. Debt-to-equity can also be used to determine the credit worthiness of the company. When the ratio is high, it means that the company has high liquidity. A business with a high ratio will be able to make its payments on its debt obligations on time and may also be able to negotiate for better terms with its creditors.

Debt-to-equity is a ratio of the debt outstanding to the equity of the company. Debt-to-capital is another measurement of a company’s profitability that compares the net debt burden with the net equity. of the company.

Debt-to-capital can be used to evaluate a business’s ability to generate cash flow. Debt-to-capital can also be used to evaluate the creditworthiness of a company. It can also be used to determine the ability of a business to meet its debt commitments. The debt-to-equity ratio and the debt-to-capital ratio are often used to determine the business’ ability to make distributions from equity holders and its ability to generate cash flow from its operations.